Keep the change

Music fills the store as shoppers wait in long lines to check out, holding items to purchase in one hand and cash in the other. A quick glance at a no-cash poster causes those without a credit card to leave the store empty–handed.

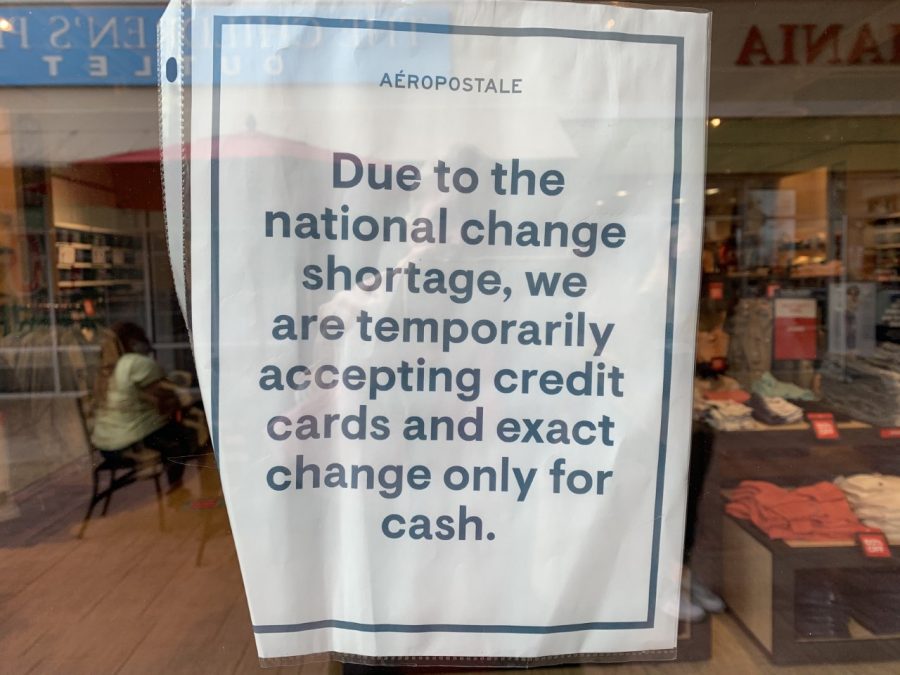

People have to consider how to pay for their purchases, cash, credit, or debit card, but cash is no longer an option at many businesses. Many stores are not accepting cash anymore due to the national coin shortage. This shortage, which began in June, is due to the lack of money being circulated during COVID-19 closures. While some may not see this as a problem with many different online methods for payment, some Etowah students prefer cold, hard cash.

“I feel like cash does not have much value anymore. I always have to be aware of how much money I have in my bank account instead of just using cash in my wallet,” Campbell Munsey, junior, said.

Many stores require exact change or credit and debit payments. Homeless people cannot get cards because some banks do not let people open up an account without a home address. If people do not have exact change, they are often forced to round up the payment. For example, if the total is $4.46, and customers do not have the exact amount, they would be required to pay $5. This rounded up total acts as an extra tax on homeless people and impoverished who are already short on money.

This extra payment leaves many worried about affording meals, especially in areas that do not have an option of rounding up purchases.

Not everyone is affected by the new “card only” rules. Many Etowah students are accustomed to using a card, as it is often much easier.

“Stores not accepting cash does not affect me very much because I rarely used cash anyways,” Makhenna Knight, freshman, said.

Due to the coin shortage and the many online options, many are unsure if cash will ever make a comeback. With a “change” in cash rules, the choice between cash or credit may no longer be a question.

Hi! My name is Grace, and I am a senior at Etowah. As my fourth year on the staff, I am the Head of Social Media and Marketing for The Talon. I am a part...